Here is a general outline you can use when designing your pitch deck. This article also covers which questions the deck should address for investors.

Fundraising process

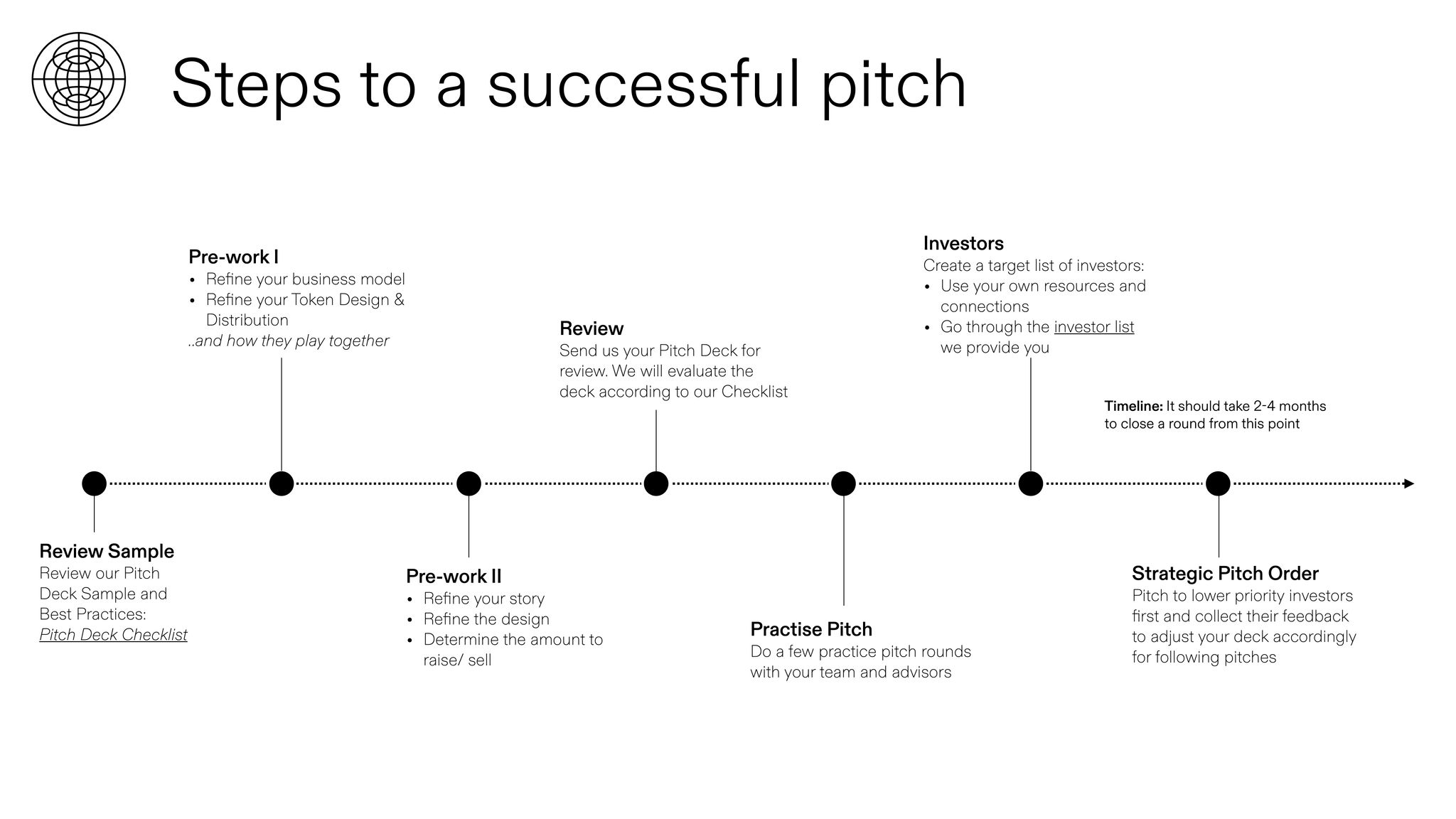

Before diving into the pitch deck itself, here is the rough outline of the fundraising process:

Key Things To Keep in Mind When Preparing Your Deck:

DO

- Clear and concise is key

- Clearly label each slide - Problem, Solution, Team, etc. to make the deck easily scannable

- You want to catch the investors attention! Put interesting and compelling things early

- Make slides simple. Use little text, explain more with graphs

- Avoid too much text on one slide

- Use larger fonts, and bigger graphics

- Good Contrast from the Background

- Make charts and stats clear, mention were the data comes from and how you got there

- Be bold, give each slide a title to let the investor know what this is about - problem, solution, product, etc..

DON’T

- Don’t overcrowd the slides with information

- Don’t take 8 slides explaining the product

- Don’t get bogged down in the technical details

- No images without titles or captions

- No screenshots and bad quality images

- Don’t include unrealistic growth forecast charts that are hockey sticks in the future

- Don’t Show overly complex diagrams or workflows

- Describe how many engineers you will hire

- Don’t make stuff up or lie

- Don’t exaggerate with the design. The design should be fitting to your brand and simple.

DIAGRAMS

Nobody understands a complicated workflow maze. If you need a diagram, keep it as simple as possible. Make it comprehensible and make sure the path from a to z is easily followed. There is no time for the investor to figure out a complex diagram.

Exceptions: Sometimes the complexity of a mechanism is essential to the pitch. In these cases we recommend you move this to the annex.

Content

- Ideally 1 slide per content bullet, max. 2

- Keep it to a maximum of 15 slides

- Create a compelling narrative

Presentation

- Have the best presenter give the pitch

- Don’t go too deep on the tech

- Be sure to check with investors on questions

Tone

You’re not asking investors for permission to continue, you’re telling them what you’re raising, and offering them a chance to come along. This sentiment should persist through every aspect of the deck, including the amount you’re raising.

Keep this in mind:

Make the idea seem simple so that everyone understands.

People are distracted easily, especially when they don’t understand.

If it takes someone more than an hour to study a deck, they are likely not to going to.

Pitch Deck Content and Checklist

Content Checklist

# | Name | Description |

1. | Title | • Logo

• One-liner / exec summary

• Contact Info / Website |

2. | Problem | • What problem are you solving?

• What is the impact? (Include data where possible).

• Be brief. Add data and market research to support your statement.

• Explain why this is actually a problem, and a big problem worth going after → High-level opportunity outline and current situation → Show how pressing the issue is to pick up the audience. |

3. | Solution | • What is your insight?

• What is the solution to the problem and how are you solving it?

• What is unique about it? Be very specific.

|

4. | Team & Advisors | • List the team members, and their backgrounds.

• List relevant experience.

• How long has the team been working together?

• Highlight specifically what, if anything, qualifies you to start this business.

• Also list key advisors and investors, if you have them, and if they are well known.

- Be clear and separate advisors from full time employees - don’t throw 20 people on a slide if actually only 5 of them are full time working on the project. |

5. | Vision / Mission | • What is your vision?

• Why did you start this?

• What is your true North?

→ This should be a clear and simple 1 liner. |

6. | Introduce the Product (Use Demo if available) | • Describe the product you are building

• What are the features

• As this is the “Solution”, you can pick up/refer to these points again, pointing out how the product is giving the solution.

• How are you doing this?

• If your solution involves a platform / defensible technology, be sure to illustrate it. Add another slide, if it makes sense.

• Show, don't tell: Embed a demo video of your solution, about 1 minute. Make it awesome. Be product obsessed.

Demo - if a demo is already available:

• Keep it simple and short - 1-2 minute max. |

7. | Economic Model | Economic model

• Describe clearly how you are creating revenue for the protocol. If you don't know yet, be ready to explain which key metrics are important for your business and why. Show that you have already started to put thought into this.

• What are the key economic activities that need to be incentivised with your token?

• How are your tokenomics incentivising key economic activities?

• Where in your project are users extracting and providing value?

→ Showcase the flow of revenue in a simple and easy to understand flow chart

|

8. | Token Design | • Why a token?

• What is the token’s utilities?

• What are the key economic activities that the token is incentivising?

• Where in your project are users providing and extracting value (linked to the token)?

• How are you linking your tokenomics to the value that the product is creating?

Token Supply and Distribution (this information can be moved to the appendix as it is not so important for your initial pitch)

• Genesis distribution

• Emission schedule

• Fully Diluted Supply

• Token Distribution |

9. | Opportunity /

Market size | • What is the market you’re going after?

• Describe your addressable market, and size it.

• Give clear backing to how you arrived at the numbers.

• Avoid top-down analysis like, "we are in $X billion market." Instead, show clearly what the actual addressable market is. Attach bottom up / unit-economics analysis to back the number.

• You can use analogies to other projects or ecosystems to showcase the potential market size |

10. | Go to market | • Who are your customers / users?

• How will you get them?

• What channels / tactics are you using to get to the targeted users?

• Through what channels are you going to bring your product to the customer?

• What is the market for the product? |

11. | Ecosystem /

Competition /

Differentiation | • Create an overview of your competitors, list each with strength and weaknesses - be earnest

• Articulate your edge in the competitive landscape. List all your major competitors and highlight their strengths.

• Make sure you make clear what differentiates you.

• If there is a comparable product (that’s good) in a different market or ecosystem, you can say something like: “the AirBnB for web3” |

12. | Roadmap /

Timeline / Traction | • Show how far the process is

• List major milestones and next steps: Show that you understand what you need to do next.

• How far is the process? Key milestones you’ve hit so far (revenue, customers, users, tech developments, etc.)

State key metrics that drive your business. Show charts, make them awesome. Speak to your metrics and growth - it is important. Even if your traction isn't huge, speaking to it illustrates you are metrics driven. Investors want to back metrics-driven founders. |

13. | Financing | • How are you planning to deploy the capital?

• What is the runway

• Describe how much you are raising

• Mention the runway and which milestones this will let you achieve.

• Good milestones are: growth milestones like revenue, customers, and users. Each financing is done to get you to either profitability or, more likely, another financing. This is why it is important to get the milestones right.

• Consider adding current financials if appropriate (Ex: lean team, need capital to accomplish X goal such as hiring, development, marketing etc.)

• How are you incorporated?

• What are you raising? - SAFE + Token Warrant / Token Side letter

|

14. | Ask / Close | • What exactly are you asking for?

• Put a closing call to action. For example:

”Looking for a lead investor to raise $3M on a $30M Valuation.”

|

Visual Design Checklist

# | Name | Description |

5. | Text Visuals & Legibility | • Is everything legible?

• Clear Text positioning?

• Are the fonts large and simple enough?

• Is the text contrast from the background good? |

2. | Slide Information & Simplicity | • Are there any slides that have an overload of information?

• Are there any slides that try to state more than one idea?

• Are there any slides that have an overload of text / long • written explanation?

• Are there any slides that seem too complex? |

3. | Statistics | • Are all stats clear?

• x / y-axis are properly named?

• Clear caption / stat explanation (1 liner)? |

4. | Diagrams | • Are there any incomprehensible diagrams?

• Can / should diagrams be simplified? |

5. | Tech | • Is there too much (unnecessary) dive into the tech? |

6. | Slides Count | • Is the overall slide number between 10-15?

• Are there too many / too littke slides?

• Are there too many slides on one specific topic? |

7. | Screenshots & Images | Are there any screenshots or bad quality pictures? |

8. | Branding | Is there excessive branding on any slides? |

References

David Teten | |

Aaron Harris |